Getting your taxes right as a freelancer can be complicated unless you’re an accountant or a bookkeeper : )

Since you’re earning an income as a freelancer, you’ll need to file the right documents and pay your taxes.

The process can be somewhat more complicated than what you’ve previously dealt with as an employee.

Hiring someone to handle your financial documentation isn’t always an option.

Especially, if you’re just getting started and you already have some business expenses to deal with each month.

In that case, you’ll need to deal with taxes on your own and in the correct way.

We’ve compiled the following list of tips and essentials to help you during every step of the way and reduce the risk of serious mistakes (that can be a real headache to resolve and that could also cost you money).

A little side note before we get started – taxes and tax policy highly depend on your location and the specific regulations there. It’s therefore best to familiarize yourself with local laws and taxation.

This guide contains general guidelines and recommendations that can be applied to most countries, but we always advise to consult a professional.

As a Freelancer, You Are a Business Owner and Not an Employee

You’re probably part of the 75% freelancers that started freelancing while working full time.

When you’re someone’s employee, you don’t have to worry about taxes for the most part.

That’s one of the perks of having an entire team dealing with documentation and all of the financial headaches linked to running a business.

As a freelancer, you have a different status. Or at least tax laws think so.

Usually, employers withhold taxes from a paycheck and a lot of the work is handled in advance.

When freelancing, you don’t have a salary. You have various projects that you send invoices for in order to record and legalize the financial aspect of getting paid.

Depending on your location, you may have to do periodic tax filings as a freelancer.

This is especially true if you’re self-employed and you haven’t registered a company to run your freelance business under.

Choosing the right kind of entity to operate as a freelancer whether it’s self-employed, a sole proprietorship or a corporation is in fact very important.

This is one of the first things you’ll have to decide and it will impact your invoicing, taxes, refunds and lots of other things.

It’s always a good idea to consult a professional about this aspect of running your business before getting started.

Registering the right entity can save you lots of money and even lower some of your taxes.

One thing is certain, however. As a freelancer, you have to keep very detailed and accurate financial records.

These will make your life much easier at the end of the year when you have to declare your income and pay the respective tax percentage.

Types of Taxes You’ll Have to Pay as a Freelancer

If you’ve already written the perfect project proposal – You’ve won a new client and earned some money as a result of that.

So, what types of taxes will you have to pay?

Freelancers who are self-employed will need to pay a self-employment tax on top of the regular income tax that applies to employees.

In the US, for example, that self-employment tax is 15.3 percent (as per 2020 data).

That percentage features both employer and employee shares since you act as both when you work as a freelancer.

If you hire a team for some of your projects, you’ll have to handle their taxes.

In that case things get more complicated. Hiring an accountant to deal with taxes is generally a good idea whenever your freelance business starts to grow.

Anyone who has registered a company will need to handle taxes in a different way.

Business taxes are different from those for self-employed individuals.

Usually, businesses have to pay a percentage of the income that they’ve earned through the year.

There are certain types of expenses that can be deducted, bringing down the overall tax.

This is why registering a company makes sense, especially if your freelance income is fairly high.

In some instances, a self-employment tax will still apply to freelancers who own and run their company.

Some additional types of taxes that may have to be handled include employment taxes (if the business employs others), sales taxes and excise tax (depending on activities and types of products being sold).

Be Careful about Local Taxes

National taxes can be pesky but they apply to everyone and they’re easy to understand and calculate.

However, the local taxes can be a real headache and very challenging depending on location as it’s not so easy to find information.

What does this mean?

Some cities and municipalities tax the businesses that operate on their territory. (Hurray!)

In the US, for example, there are nearly 5,000 cities and counties that collect local taxes from freelancers and other kinds of businesses.

It doesn’t matter if you work with local or international clients.

The local taxes will still apply because you’re basing your freelance business on that specific address.

Freelance Business Tax Deductions

When it comes to paying taxes as a freelancer, it’s not all bad news.

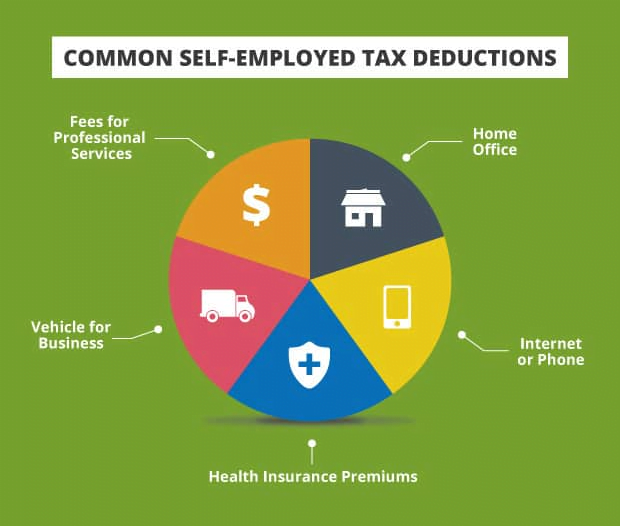

Because you’re running a business, you are entitled to various types of deductions that reduce the size of your income that the tax percentage is being calculated against.

Freelancers can write off various types of expenses.

A few of those include:

- Office expenses

- Tech expenses for required equipment and materials (computers, software products, internet access)

- Lodging and travel expenses (if you’re a photographer or a video editor, for example, who needs to do work at different locations based on client requirements)

- Business-related food expenses

If you work in a home office, you may get the perfect opportunity to benefit from some additional deductions.

Utility costs like electricity and phone can usually be included among the business expenses whenever you operate from a residential venue.

Again, your location could qualify you for additional deductions and possibilities to reduce your revenue for tax calculation purposes.

Always go through the tax authority’s guidelines for income calculation to determine exactly what you can write off as a business expense.

In some instances, business-related expenses will be dependent on the line of work that you do and the industry that you represent.

Tax Deadlines & Document Filing

When you’re a freelancer and a self-employed individual, you and your business are one and the same entity for tax purposes.

That means you’ll have to file taxes just once.

The same applies to sole proprietors.

Those who run corporations (LLC or any other form of corporate entity) will need to do a bit more work when it comes to filing their taxes.

For a start, you are employed by your company.

This means you have to file taxes both as a corporation and as an employee.

The first time around, such a task may seem daunting. When you handle filing once or twice, however, you’ll get much more comfortable with the required documentation.

You may be thinking that registering a corporation is a bad idea because of complications.

But as a corporate entity you can reduce certain types of taxes.

The claim is especially true for freelancers who earn higher incomes.

Again – talking to an accountant will give you a good idea about saving some money and reducing your taxes.

Registering a corporate entity can come with additional perks, so don’t discount this possibility immediately.

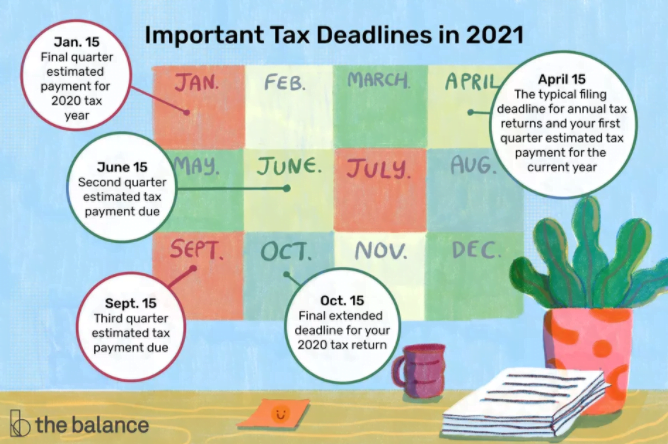

Keep in mind that filing deadlines for freelancers could be different from those for individuals who earn a salary as an employed professional.

As far as tax authorities are concerned, these are separate entities. As a result the tax season ends on different dates in most countries.

Get Organized ASAP!

Don’t wait until the last minute to organize invoices, bills and other financial documents you’ll need to use for tax, deduction and refunds.

Maintaining accurate books throughout the year will save you a lot of time when tax season arrives.

Not only that, you could actually handle tax documents early enough to benefit from discounts and some other opportunities to save money.

It’s very important that your financial records are comprehensive and accurate.

File them by date and also by type.

It’s best to use a financial management software for digital invoices and documentation.

If you have paper copies, you may want to get those scanned and added to your digital bookkeeping records.

Sometimes, you will have to prove expenses and provide additional documentation to taxation authorities.

This is why you shouldn’t discard receipts or invoices. Keep them until all taxes have been sorted out.

There could also be document retention requirements that oblige you to keep financial data for a certain number of years.

By keeping books and all files you’ll be reducing the risk of going through challenging audits which eventually lead to dealing with fines.